Already a subscriber? Activate your premium account

Potatoworld Magazine

Potatoes have been scarce and expensive, but remain highly sought after. This concludes RaboResearch in its latest report, ‘US Potato Outlook 2023/24: After a Record-breaking Year, What Is in Store for US Potatoes?’.

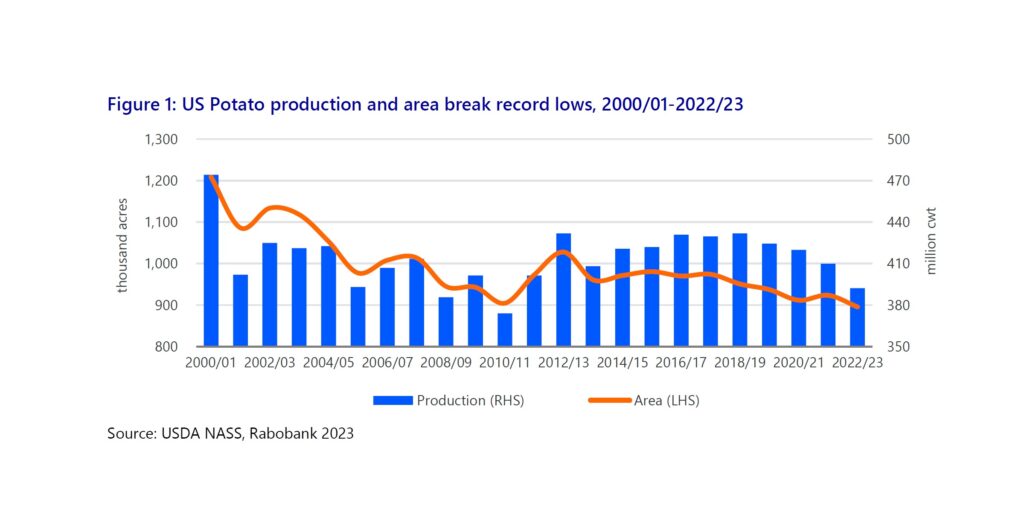

US potato production declined for the fourth consecutive year, reaching its lowest level since 2010, while the harvested area was the smallest on record. Potato prices surged to their highest levels accordingly, while strong demand for frozen potatoes also contributed to the high price environment.

‘Strong open market prices and strong demand for frozen potatoes are typically sufficient reasons to raise contract prices, particularly since heightened demand for processing potatoes has gone unmet for two years running and fryers were able to pass on costs to consumers without a loss in sales’, the report states. ‘Competitive open market and higher contract potato prices, an improved water outlook, and crop rotation pressures are expected to increase potato planted area by 2 percent year-on-year and lead to a 7 percent drop in price in the 2023/24 marketing year.’

According to the RaboResearch report, growers, through their cooperatives and associations, are in a good position this year to negotiate better contract prices with processors. Fryers, who had to rely on imports and sourcing raw inventories from other regions with better supply situations, have strong economic incentives to increase contract prices and improve contract terms, given strong demand for finished products. Although consumers will pay higher prices for fresh potatoes, French fries, and other frozen potato products, they are not expected to reduce their potato consumption. The potato is extra precious during a period of inflation, when consumer purchasing power is eroded.

The report ends with the takeaway that the current marketing year has been a very good one for independent potato growers. On average, the price increase of open market potatoes is twice that of potatoes under contract. Will this improve growers’ bargaining position when negotiating contracts for the 2023/24 marketing year? Fundamentally, the answer is yes, RaboResearch believes. ‘Grower cooperatives and/or associations that negotiate on behalf of potato growers can leverage the spread in price, to improve contract price and terms. Grouwers ought to keep in mind, however, that record-high prices may not last for another year should a return on average yields and a >2 percent increase in planted area materialize. At that level of production, potato prices could potentially drop faster than unit costs, squeezing margins.’

Analysts also deem it very likely that processors will be willing to pay higher contract prices this year, ‘given the high opportunity costs processors face should they be unable to fully use their processing capacity to meet increasing foodservice orders and continued strong retail demand. Processors may also find that improving contract terms is a much more effective option to mitigate the risk and additional costs of relying on imports and/or supply from distant regions to secure their raw inventories.’

RaboResearch expects consumers ‘to continue paying record retail prices for their humble fresh and frozen potatoes, particularly russets, until a bountiful new crop hits the market. Despite the high prices, potatoes remain one of the few basic food categories for which consumers are willing to increase their per capita consumption when purchasing power is weakened.’

Events

©2015 - 2024 Potatoworld | Webdesign and realisation COMMPRO